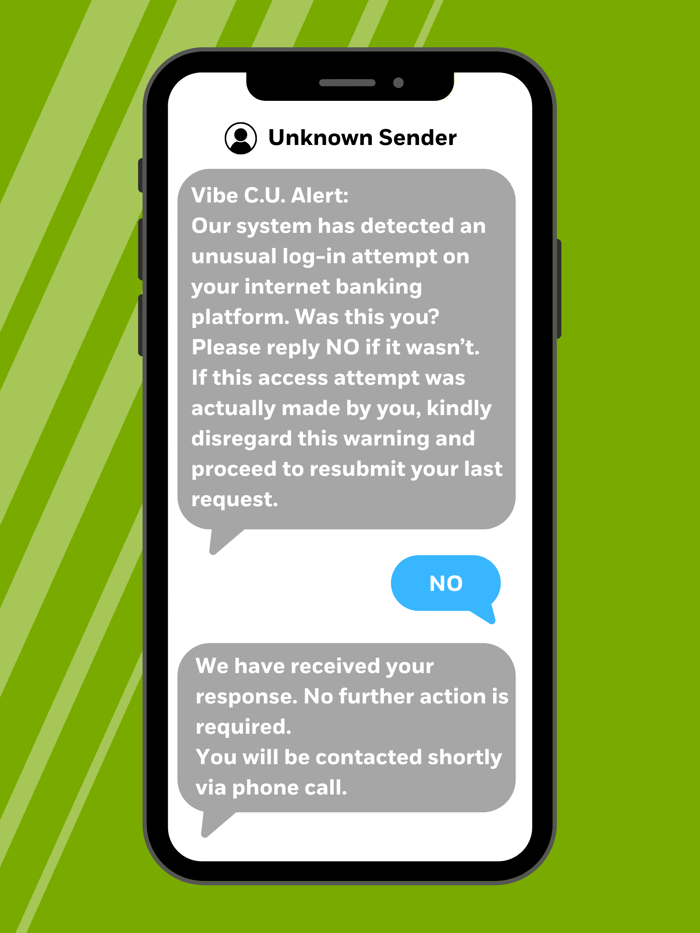

Impersonation scams are on the rise. What might look like a legitimate security alert could actually be a deceptive text from a scammer, designed to trick you into sharing personal information and giving them access to your money. Think twice before responding — a quick reply could unknowingly be putting your finances and identity at risk.

How do impersonation scams work?

Impersonation scams typically begin with a text message from an unfamiliar number claiming to represent your financial institution. Frequently sent from out of state area codes, these messages prompt you to confirm or deny a suspicious card charge by replying ‘yes’ or ‘no’. While responding may seem like the responsible thing to do, engaging may actually put you and your account at greater risk. Responding confirms that your phone number and account are valid — giving scammers what they need to carry out more targeted fraud and putting your personal information and money in potential danger.

Next, the scammer follows up with a phone call, posing as a legitimate representative and asking a series of verification questions that mimic standard security procedures. As you answer these questions, scammers take the information you’ve provided and attempt to log into your online banking. This triggers a second round of text verification codes — which the scammer urgently asks you to share. While it may seem as though the person you are talking to is a legitimate team member, instead, they use these codes to gain unauthorized access to your online accounts and commit fraud — all while reassuring you that they are actively working to recover lost funds.

How do scammers gather personal information?

Using information gathered from social media, past data breaches and credit leaks, scammers craft convincing questions about recent transactions, login activity, and personal information under the guise of security verification. With a calm, reassuring tone and seemingly legitimate insights into your life and banking history, scammers gain your trust, manipulate you into providing complete access to your accounts, and successfully commit fraud.

What other tactics are scammers using?

Recently, scammers have adopted an alarming new tactic: convincing individuals to visit branch locations, withdraw funds, and deposit them into non-proprietary, shared ATMs. By creating a false sense of urgency and legitimacy, they claim that depositing funds is necessary to protect your account and stop fraudulent activity. In reality, following these instructions can result in significant financial loss and make it far more difficult to trace or recover stolen funds.

How can I prevent falling victim to an impersonation scam?

Pause Before You Respond

If you receive an unexpected phone call or text, don’t respond right away. Instead, reach out to your financial institution using a trusted method — such as a verified website, a known phone number, or by visiting a branch in person. Taking this extra step ensures that you’re speaking with a legitimate, trusted representative who is fully focused on protecting you and keeping your funds and accounts safe.

Never Provide Verification Codes

Verification codes are designed to add an additional layer of security, ensuring that only you can access your protected accounts. Because these codes are typically valid for a few minutes, scammers rely on urgency to trick you into sharing them. If someone pressures you to provide a code right away, be cautious — their urgency is a major red flag and a telltale sign that you may be dealing with a scammer.

Never Move Money Based on an Unexpected Call

If someone asks you to move your money, make a deposit, or complete a withdrawal — don’t. Legitimate financial institutions will never instruct you to transfer funds, withdraw cash, or make changes to your account as a way to protect it. Scammers may try to convince you that performing a transaction or making a change to your account is necessary to safeguard your money — but that’s simply not true. If you receive such a request, do not engage. Instead, contact your financial institution directly using a verified communication method for more assistance.

Stay Alert and Protected

By staying vigilant and following these simple precautions, you can protect your personal information and keep your accounts secure. If you believe that your Vibe Credit Union account is at risk — or if you’ve been contacted by someone who you believe is posing as us — don’t hesitate to reach out. Visit us online, in branch, or call us directly at 248-735-9500. We’re here to help.

Impersonation scams can be sophisticated — but they only succeed when they catch us off guard. By staying alert, pausing before responding and remembering that real financial institutions will never pressure you for private information or payment, you can stop scammers before their plans unfold. Remember to always trust your instincts — if something feels off, it probably is. If you suspect that you’ve encountered an impersonation scam, don’t let urgency override caution — slow down, verify the source, and contact your financial institution directly using a trusted method to keep your accounts and information safe and secure. Scammers may be clever, but with a little caution and confidence, you can stay one step ahead.